This Synthetic Intelligence (AI) Software program Firm Might Be the Subsequent Palantir

For fairly a while, the view surrounding Palantir Applied sciences (NYSE: PLTR) was caught someplace between a generational software program developer or an “AI imposter,” relying on whom you ask. One of many greatest causes for this polarizing viewpoint is that many buyers merely don’t perceive what Palantir truly does.

Juxtaposing business buzzwords comparable to “AI” and “data-driven insights” will solely get you thus far. In some unspecified time in the future, a enterprise must show that it is advertising techniques are bearing fruit. And, in reality, over the previous 12 months Palantir has witnessed a brand new wave of progress due to its lineup of information analytics software program platforms.

The corporate has not solely accelerated its prime line, but it surely’s additionally been constantly increasing revenue margins and has transitioned from a cash-burning operation to a worthwhile enterprise. Lately, Palantir turned a member of the S&P 500 and is working carefully with among the tech sector’s largest incumbents, together with Microsoft and Oracle.

Right this moment, one other firm on this sector additionally deserves a more in-depth look: ServiceNow (NYSE: NOW). Ever heard of it? I’ll element how ServiceNow is quietly disrupting the world of enterprise software program — just like what Palantir has finished. Furthermore, I will discover how AI is taking part in a serious function within the firm’s present progress trajectory and assess if now’s a profitable alternative to scoop up shares.

What does ServiceNow do?

A couple of 12 months in the past, ServiceNow CEO Invoice McDermott sat down for an interview with David Rubenstein — a non-public fairness investor and former coverage advisor throughout President Jimmy Carter’s administration.

When requested about what ServiceNow truly does, McDermott merely referred to the corporate because the “IT spine” for companies seeking to construct out digital infrastructure. Whereas I respect the metaphor right here, I will admit that this rationalization continues to be just a little imprecise.

Let’s take a look at an instance to higher perceive the ServiceNow platform. From finance, gross sales and advertising, operations, human assets, and IT administration, companies have a separate division for nearly every thing. In consequence, organizational workflows might be slow-moving, and staff might be left ready for an optimum answer for hours and even days.

That is the place ServiceNow is available in. The corporate provides a complete suite of SaaS-based instruments and companies aimed to assist streamline generic inefficiencies inside organizations. This helps staff and staff members higher monitor the standing of vital points or initiatives, finally driving increased productiveness.

How is AI a tailwind for ServiceNow?

Like many software program corporations, ServiceNow is seeking to journey the AI wave. And on the floor, the corporate appears to be doing a very good job. Since AI turned the speak of the city, ServiceNow has signed some high-profile partnerships with Microsoft, IBM, and Nvidia, simply to call a number of. However as I alluded to, advertising strategic alliances and doing extremely publicized interviews is just one a part of the equation.

How is ServiceNow’s enterprise truly performing? Fairly solidly, if you happen to ask me.

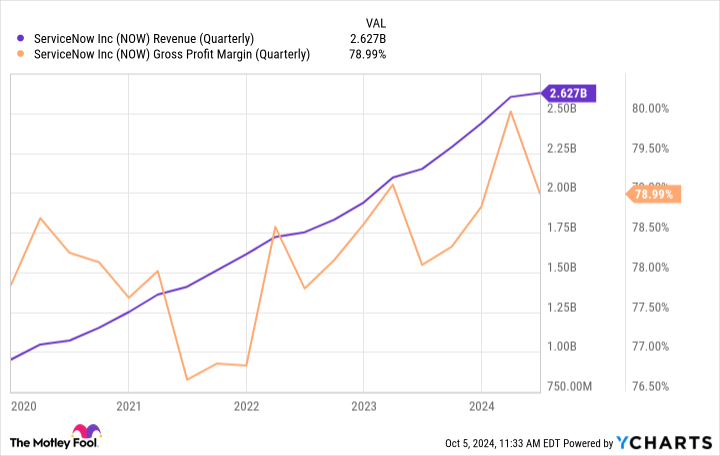

As depicted within the chart, ServiceNow’s income and gross revenue margin have been rising considerably during the last a number of years. Diving a bit deeper right here, take a look at the expansion traits beginning in 2023 — roughly the interval throughout which AI began to land on extra radars.

Simply during the last 20 months or so, ServiceNow’s income line begins to witness a noticeably steeper slope, whereas revenue margins concurrently develop. What’s even higher is the mixture of accelerating gross sales and wider margins is resulting in constant profitability — each from a web earnings and free money circulation perspective.

Is ServiceNow inventory a purchase proper now?

Though ServiceNow is constantly worthwhile, the magnitude of its web earnings and money circulation fluctuates fairly a bit. Bear in mind, ServiceNow is a progress firm, so it’s continually reinvesting extra earnings again into the enterprise.

Because of this, utilizing profit-based valuation metrics comparable to price-to-earnings (P/E) or price-to-free money circulation (P/FCF) aren’t solely helpful. As an alternative, I’m going to take a look at the ratio between enterprise worth and income.

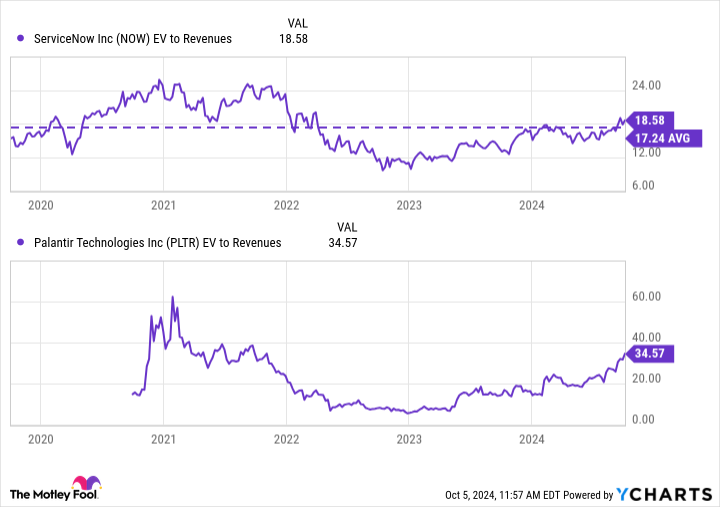

Proper now, ServiceNow trades at an EV-to-sales a number of of 18.6 — primarily consistent with its five-year common. However if you happen to take a more in-depth take a look at the overarching traits, there’s a lot that may be gathered from these charts.

Following a quick pop in 2020, each ServiceNow’s and Palantir’s valuation multiples compressed fairly considerably between 2021 and 2023. A lot of this was resulting from macro components comparable to inflation and rising rates of interest, and their toll on the enterprise software program market as a complete.

Nevertheless, because the AI daybreak become visible round 2023, ServiceNow and Palantir began witnessing some valuation growth. What’s peculiar is that even with this valuation growth, ServiceNow’s EV-to-revenue is principally again to the place it was a number of years in the past.

When you think about the truth that ServiceNow is a a lot bigger, worthwhile enterprise in the present day in comparison with 2020, I believe that there’s an argument to be made that the inventory is undervalued — regardless of the gradual uptick in valuation during the last two years.

To me, the market is starting to catch on to ServiceNow, kind of because it did with Palantir. Nevertheless, I nonetheless assume ServiceNow just isn’t but absolutely appreciated concerning how it’s taking part in an integral function on the crossroads of AI and enterprise software program.

For these causes, I believe now is a good time to purchase ServiceNow inventory, and I see the corporate following a really related narrative and trajectory to that of Palantir because the AI narrative continues to take form.

Do you have to make investments $1,000 in ServiceNow proper now?

Before you purchase inventory in ServiceNow, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and ServiceNow wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $814,364!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of October 7, 2024

Adam Spatacco has positions in Microsoft, Nvidia, and Palantir Applied sciences. The Motley Idiot has positions in and recommends Microsoft, Nvidia, Oracle, Palantir Applied sciences, and ServiceNow. The Motley Idiot recommends Worldwide Enterprise Machines and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

Prediction: This Artificial Intelligence (AI) Software Company Could Be the Next Palantir was initially revealed by The Motley Idiot