The Underrated Transfer Shaping Its Future

[ad_1]

PepsiCo (NASDAQ: PEP) is greatest recognized for its soda merchandise and snacking choices beneath the Frito-Lay model. It’s a highly effective associate as retailers look to draw prospects into their shops. And the corporate simply received just a little bit higher after asserting plans to purchase Siete Meals for $1.2 billion, regardless that Wall Avenue barely seen the deal. Here is why the acquisition is so vital.

What does PepsiCo do?

PepsiCo’s identify would recommend it is a beverage maker, which it’s. Nevertheless it’s a lot greater than that. It’s actually a meals conglomerate, with manufacturers that span from drinks (Pepsi) to salty snacks (Frito-Lay) to packed meals (Quaker Oats). And people are only a few of its iconic manufacturers; it additionally owns Gatorade, Doritos, Tostitos, Muscle Milk, Smartfood, and Close to East, amongst many others. It’s a very important associate to retailers and comfort shops world wide.

The corporate’s scale is spectacular, with a market cap of roughly $230 billion. Revenues in 2023 tallied as much as roughly $91.5 billion. Yow will discover its manufacturers in over 200 nations and territories world wide. Its distribution and advertising and marketing prowess is phenomenal and it’s simply one of many largest and strongest shopper staples corporations on Wall Avenue.

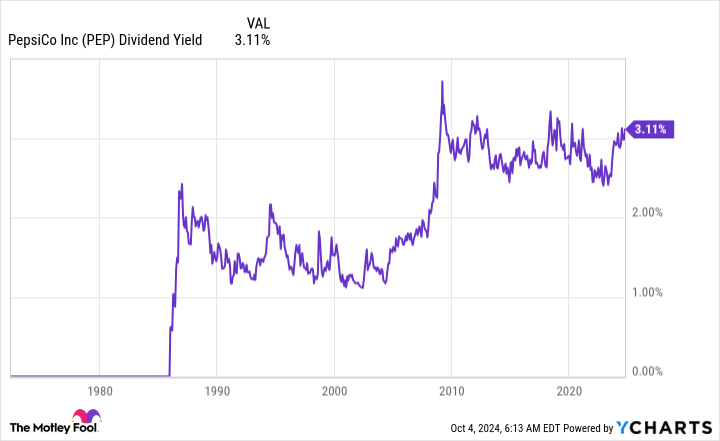

Buyers ought to discover the corporate very engaging typically. However proper now it additionally appears fairly engaging, valuation sensible. PepsiCo’s price-to-sales, price-to-earnings, price-to-book worth, and price-to-cash circulation ratios are all beneath their five-year averages. The inventory’s 3.2% dividend yield is towards the excessive finish of its historic yield vary. The yield can also be notably greater than that of the two.6% common yield of shopper staples sector, utilizing the Client Staples Choose Sector SPDR ETF (NYSEMKT: XLP) as an trade proxy. Merely put, PepsiCo appears pretty priced, if not just a little low cost, proper now.

From a primary degree, then, dividend buyers ought to most likely be taking a look at PepsiCo, noting that it has elevated its dividend yearly for a powerful 52 consecutive years. That, for reference, makes it a Dividend King.

What about PepsiCo’s Siete acquisition?

With PepsiCo’s many highly effective manufacturers and large gross sales base, it’s comprehensible that Wall Avenue did not get enthusiastic about its $1.2 billion deal to accumulate Siete Manufacturers. The inventory has mainly gone nowhere because the deal was introduced. And simply to place a quantity on this, Siete is estimated to have revenues of round $500 million, which is lower than 1% of PepsiCo’s 2023 revenues.

So it is a small transaction that will not actually transfer the needle for PepsiCo. Nevertheless it seems to be attractively priced, at round 2.4 occasions gross sales, so PepsiCo is not overpaying. And the financially sturdy firm ought to have little drawback developing with the money to pay for Siete. Thus there’s little concern that the deal will result in any monetary disruption at PepsiCo. In some ways it’s form of a non-event.

However strategically, it’s vitally vital. If you happen to look at the complete checklist of manufacturers that PepsiCo owns, together with a few of its largest and most vital nameplates, it merely did not create all of them. It purchased them. Gatorade is a good instance, because the model was the crown jewel of Quaker Oats when PepsiCo purchased that firm. It is among the most dominant sports activities drink manufacturers and catapulted PepsiCo to the top of that product area of interest at a time when PepsiCo’s personal choices there have been missing. This is not to recommend the Siete is the subsequent Gatorade. It is not. Nevertheless, the method taken with Gatorade is mainly the identical one which’s being taken with Siete.

There’s overlap between what Siete produces and what Pepsico makes, most notably within the chip class. However Siete, a self described Mexican-American meals firm, additionally has choices within the sauce, seasoning, bean, tortilla, taco shell, and sweets areas. It helps increase Pepsico’s attain in areas it already competes and, maybe, even pushes the corporate a bit additional into the hispanic meals class.

PepsiCo is shopping for a powerful, up-and-coming model that it could use to develop its general enterprise. Simply plugging Siete into PepsiCo’s highly effective advertising and marketing and distribution techniques will possible increase its gross sales. Extra importantly, it provides PepsiCo much more attain within the salty snack meals phase. Though not an enormous deal in and of itself, this bolt-on acquisition method is how PepsiCo constructed its dominant place and the way it maintains it over time.

No large deal and but a really large deal

PepsiCo’s Siete acquisition is not more likely to instantly transfer the needle for the corporate, which is why buyers did not pay all that a lot consideration. However if you happen to suppose in a long time and never days, the deal represents the successful enterprise method that PepsiCo has used for many years to increase its enterprise — and, simply as vital, to reward dividend buyers effectively alongside the best way. In case you are a dividend investor, Siete is simply another reason to love PepsiCo whereas its inventory seems to be on the sale rack.

Don’t miss this second probability at a doubtlessly profitable alternative

Ever really feel such as you missed the boat in shopping for essentially the most profitable shares? Then you definately’ll wish to hear this.

On uncommon events, our professional group of analysts points a “Double Down” stock suggestion for corporations that they suppose are about to pop. If you happen to’re nervous you’ve already missed your probability to speculate, now’s the perfect time to purchase earlier than it’s too late. And the numbers converse for themselves:

-

Amazon: if you happen to invested $1,000 once we doubled down in 2010, you’d have $20,855!*

-

Apple: if you happen to invested $1,000 once we doubled down in 2008, you’d have $43,423!*

-

Netflix: if you happen to invested $1,000 once we doubled down in 2004, you’d have $392,297!*

Proper now, we’re issuing “Double Down” alerts for 3 unbelievable corporations, and there might not be one other probability like this anytime quickly.

*Inventory Advisor returns as of October 7, 2024

Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

PepsiCo’s $1.2 Billion Siete Purchase: The Underrated Move Shaping Its Future was initially revealed by The Motley Idiot

[ad_2]

Source