Historical past Says This Vanguard ETF May Be Your Ticket to a Million-Greenback Portfolio

[ad_1]

Nobody monetary objective applies to everybody. Monetary conditions range a lot that what one individual strives for might utterly differ from another person’s priorities.

That stated, $1 million has lengthy been a acknowledged mark of monetary success. I need to admit, there’s one thing about seeing a second comma in a quantity that feels validating and comforting.

The excellent news is that it does not take “hitting it large” or generational returns to make a million-dollar portfolio a actuality. In lots of instances, all it takes is constant investments in an exchange-traded fund (ETF) just like the Vanguard S&P 500 ETF (NYSEMKT: VOO).

If there’s one ETF to lean on en path to a million-dollar portfolio, it might be this one. Here is why.

A historical past of spectacular and inspiring returns

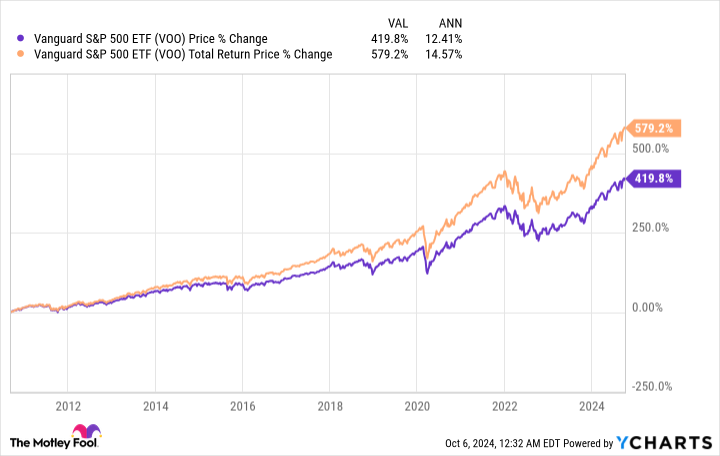

This ETF was created in Sept. 2010, and since then it has been on a formidable run, averaging over a 12.4% annual return and over 14.5% annual total returns.

It has been repeated loads of instances that “previous outcomes do not assure future efficiency.” Nevertheless, if this development continues, this is how lengthy it might take you to hit the million-dollar mark, averaging 12% annual returns at totally different month-to-month contributions.

|

Month-to-month Contributions |

Years Till $1 Million |

|---|---|

|

$500 |

27 |

|

$750 |

24 |

|

$1,000 |

22 |

|

$1,500 |

18 |

|

$2,000 |

16 |

Calculations by creator. Years rounded to the closest entire 12 months.

You do not want a lump sum of cash to speculate to get to a million-dollar portfolio; you want constant investments over time.

Getting publicity to a few of the world’s greatest firms

I at all times wish to say that investing in an S&P 500 ETF is akin to investing within the U.S. economic system. After all, the U.S. economic system runs off extra than simply 500 firms, however their affect is plain contemplating the dimensions and scope of the businesses within the S&P 500 index. Listed below are the highest 10 holdings on this ETF (as of Aug. 31):

-

Apple: 6.97%

-

Microsoft: 6.54%

-

Nvidia: 6.20%

-

Amazon: 3.45%

-

Meta Platforms: 2.41%

-

Alphabet (Class A): 2.03%

-

Berkshire Hathaway (Class B): 1.82%

-

Alphabet (Class C): 1.70%

-

Eli Lilly: 1.62%

-

Broadcom: 1.50%

Whenever you’re attempting to construct a million-dollar portfolio, the one factor you want is consistency. There’ll inevitably be ups and downs alongside the best way (no inventory or ETF is exempt from volatility), however you need firms with a historical past of long-term progress main the best way — and that is what these have confirmed.

Do not overlook how a lot cash it can save you in charges

An underrated a part of this ETF is the low expense ratio of 0.03%. That works out to $0.30 per $1,000 invested yearly, and it is one of many most cost-effective you will discover from any ETF on the inventory market, no matter kind. Even one other S&P 500 ETF, the SPDR S&P 500 Belief ETF, is greater than thrice dearer at 0.0945%.

To offer you some perspective, this is how a lot you’d pay in charges over 20 years by investing totally different quantities and averaging 10% annual returns in each ETFs.

|

Month-to-month Contributions |

Charges Paid With Vanguard S&P 500 ETF |

Charges Paid With SPDR S&P 500 ETF |

|---|---|---|

|

$500 |

$1,160 |

$3,660 |

|

$750 |

$1,750 |

$5,500 |

|

$1,000 |

$2,330 |

$7,330 |

|

$1,500 |

$3,500 |

$10,990 |

|

$2,000 |

$4,670 |

$14,660 |

Calculations by creator. Charges rounded all the way down to the closest 10.

The seemingly slightest distinction on paper might prevent hundreds in charges over time. Do not overlook it.

Must you make investments $1,000 in Vanguard S&P 500 ETF proper now?

Before you purchase inventory in Vanguard S&P 500 ETF, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for traders to purchase now… and Vanguard S&P 500 ETF wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $826,130!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of October 7, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Stefon Walters has positions in Apple, Microsoft, and Vanguard S&P 500 ETF. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Vanguard S&P 500 ETF. The Motley Idiot recommends Broadcom and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

History Says This Vanguard ETF Could Be Your Ticket to a Million-Dollar Portfolio was initially revealed by The Motley Idiot

[ad_2]

Source