Asian Shares Rise Monitoring US Beneficial properties; Oil Declines: Markets Wrap

[ad_1]

(Bloomberg) — Shares in Asia climbed after one other sturdy efficiency on Wall Road, with shares hitting contemporary file highs. Oil dropped as considerations eased about Israel attacking Iranian vitality services.

Most Learn from Bloomberg

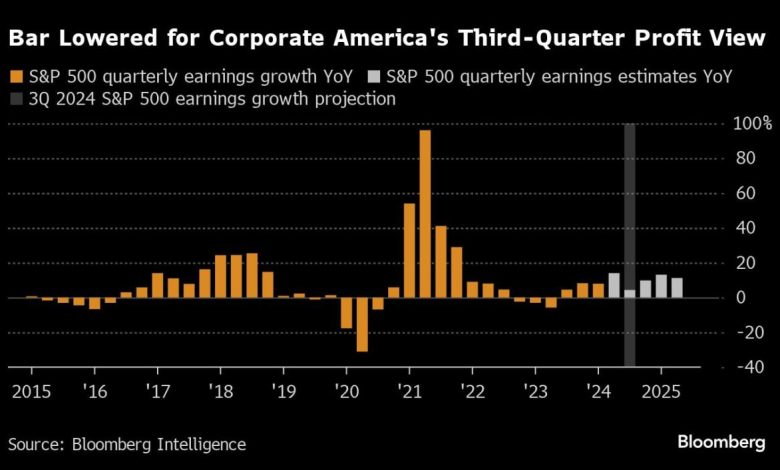

Benchmark indexes have been up in Australia and Japan, and US futures superior barely. With earnings studies poised to drive US sentiment this week, the S&P 500 rose virtually 1%, notching one other file — its forty sixth this 12 months. That’s a touch traders will not be deterred by the diminished forecasts for third-quarter outcomes and are as a substitute betting on constructive surprises.

Asian traders might be on the look ahead to additional stimulus from the Chinese language authorities after the nation’s shares posted their largest achieve in per week on Monday, suggesting that traders are hopeful the federal government will ship on its promise of extra fiscal assist.

“I feel it’s crucial that we get the 2 elements of stimulus collectively, the financial stimulus and the fiscal stimulus, and we’re getting each.” stated Kristina Hooper, chief international market strategist at Invesco, on Bloomberg Tv. “The fiscal stimulus goes to handle key areas that I feel will result in enhancements that profit the economic system and markets over the medium and long run.”

Oil dropped virtually 3% in early buying and selling after the Washington Submit reported that Israel doesn’t plan on hanging Iranian oil or nuclear services. That prolonged losses from Monday after China’s extremely anticipated Finance Ministry weekend briefing lacked particular new incentives to spice up consumption on the planet’s largest crude importer.

The S&P 500 hovered close to 5,860 on Monday amid skinny buying and selling quantity, with futures little modified early Tuesday. The Nasdaq 100 added 0.8%. The Dow Jones Industrial Common climbed 0.5%. Nvidia Corp. led positive factors in megacaps, Apple Inc. gained on a bullish analyst name and Tesla Inc. rebounded after final week’s plunge. Goldman Sachs Group Inc. and Citigroup Inc. superior forward of outcomes.

Treauries have been little modified after money buying and selling was closed for a US vacation on Monday. The yen ticked greater versus the greenback, although remained not removed from the 150 degree.

China could increase 6 trillion yuan ($846 billion) from ultra-long particular authorities bonds over three years as a part of its efforts to spice up the sputtering economic system, Chinese language media outlet Caixin reported.

Nonetheless, there are extra indicators of financial weak spot as a report Monday confirmed export development in September unexpectedly climbed simply 2.4% in greenback phrases from a 12 months earlier to the bottom degree since Might. A gauge of US-listed Chinese language shares fell greater than 2% in a single day.

In the meantime, in a present of scorching demand for Japan’s largest itemizing in six years, Tokyo Metro Co.’s preliminary public providing has raised ¥348.6 billion ($2.3 billion) after the corporate priced shares on the high of the marketed vary, folks aware of the matter stated.

Markets are additionally anticipating Hong Kong chief John Lee’s annual speech on Wednesday, when he’s anticipated to make bolstering the economic system a precedence and lay out an agenda that features a potential minimize to a liquor tax and potential measures to strengthen town’s standing as a finance heart.

Within the US, earnings season unofficially kicked off on Friday, led by monetary bellwethers JPMorgan Chase & Co. and Wells Fargo & Co. On high of different massive banks reporting this week, merchants might be paying shut consideration to outcomes from key corporations like Netflix Inc. and JB Hunt Transport Companies Inc.

An preliminary spherical of third-quarter monetary outcomes final week confirmed Company America is benefitting from decrease charges early into the Federal Reserve’s easing cycle, in line with Financial institution of America Corp. strategists.

Strategists are predicting S&P 500 companies will put up their weakest outcomes prior to now 4 quarters, with only a 4.3% enhance in contrast with a 12 months in the past, Bloomberg Intelligence knowledge present. Meantime, company steerage implies a soar of about 16%. That strong outlook suggests corporations may simply beat market expectations.

Easing charges strain was seen in a surge in debt underwriting, mortgage purposes and refinancing exercise, in addition to indicators of a backside in manufacturing, the BofA staff together with Ohsung Kwon and Savita Subramanian stated.

To Solita Marcelli at UBS World Wealth Administration, third-quarter outcomes ought to affirm that large-cap company revenue development is strong in opposition to a resilient macro backdrop.

Marcelli maintains a “constructive outlook for US equities,” reiterated her S&P 500 worth goal of 6,200 by June 2025, and continues to love “AI beneficiaries and high quality shares.”

Key occasions this week:

-

Eurozone industrial manufacturing, Tuesday

-

Goldman Sachs, Financial institution of America, Citigroup earnings, Tuesday

-

Fed’s Mary Daly, Adriana Kugler converse, Tuesday

-

Morgan Stanley earnings, Wednesday

-

ECB price determination, Thursday

-

US retail gross sales, jobless claims, industrial manufacturing, Thursday

-

Fed’s Austan Goolsbee speaks, Thursday

-

China GDP, Friday

-

Fed’s Christopher Waller, Neel Kashkari converse, Friday

A number of the predominant strikes in markets:

Shares

-

S&P 500 futures have been little modified as of 9:08 a.m. Tokyo time

-

Japan’s Topix rose 1.1%

-

Australia’s S&P/ASX 200 rose 0.7%

-

Euro Stoxx 50 futures rose 0.7%

Currencies

-

The Bloomberg Greenback Spot Index was little modified

-

The euro was little modified at $1.0906

-

The Japanese yen was little modified at 149.68 per greenback

-

The offshore yuan was little modified at 7.0930 per greenback

Cryptocurrencies

-

Bitcoin rose 0.2% to $66,031.57

-

Ether rose 0.3% to $2,628.55

Bonds

-

The yield on 10-year Treasuries was little modified at 4.10%

-

Japan’s 10-year yield declined one foundation level to 0.945%

-

Australia’s 10-year yield declined two foundation factors to 4.25%

Commodities

This story was produced with the help of Bloomberg Automation.

–With help from Shery Ahn.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.

[ad_2]

Source