Australian postcodes most vulnerable to mortgage stress are revealed in Sydney Melbourne Perth

[ad_1]

Working {couples} who purchased a home in an outer suburb the place costs are sometimes within the seven figures face shedding cash if mortgage stress forces them to promote.

In much less trendy elements of Sydney, Melbourne and Perth, dwelling debtors make up nearly all of residents within the midst of a cost of living disaster – and with two extra charge rises tipped by August.

However in a single area of western Sydney, the variety of properties going in the marketplace is surging by double-digit figures in simply 4 weeks, after the Reserve Financial institution this month raised charges for the twelfth time since Might 2022.

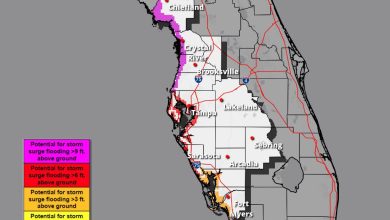

Suburbs with newer homes north of Blacktown – together with within the 2148 and 2763 postcodes – have median home costs of greater than $1million, rising the probability of mortgage stress.

Those that purchased early final 12 months, earlier than rates of interest rose, face owing the financial institution greater than their house is price as costs fall – a scenario often called adverse fairness.

CoreLogic Australia’s head of analysis Eliza Owen stated a current large enhance in new listings in these areas might significantly damage struggling debtors pressured to promote as extra provide brings down costs.

Working {couples} who purchased a home in an outer suburb the place costs are sometimes within the seven figures face shedding cash if mortgage stress forces them to promote (pictured are new properties in Blacktown in Sydney’s west)

‘This might make it harder for current consumers to make a capital acquire if they’re struggling to satisfy mortgage repayments,’ she stated.

‘As purchaser demand wanes amid increased curiosity prices and seasonal traits, there could possibly be an prolonged downturn in a few of these markets.

‘In areas reminiscent of Blacktown North, the place values have seen a robust bounce again within the three months to Might, as provide creeps up it could put downward stress on the expansion development within the coming months.’

The Blacktown North space in Sydney’s west is especially dangerous with 55.5 per cent of households having a mortgage, based mostly on 2021 Census knowledge as mapped by the Australian Bureau of Statistics.

The variety of properties going in the marketplace has risen by 24.3 per cent in the course of the previous 4 weeks in an space that covers suburbs north of the M7 motorway, together with Quakers Hill, Schofields and Riverstone the place median home costs are within the seven figures.

‘It’s noticeable that new listings volumes are climbing in a few of these markets, the place the nationwide development is seeing a seasonal slowdown,’ Ms Owen stated.

In suburbs south of the M7 motorway – within the Blacktown space – costs have already fallen under the seven-figure mark.

The Blacktown North space in Sydney’s west is especially dangerous with 55.5 per cent of households having a mortgage, based mostly on 2021 Census knowledge as mapped by the Australian Bureau of Statistics

In Seven Hills, the median home value plunged by eight per cent to $929,102, down from $1,009,471 within the 12 months to Might, CoreLogic knowledge confirmed.

Different close by suburbs have additionally fallen out of the million-dollar membership, together with Prospect the place values have fallen by 7.4 per cent to $928,922, down from $1,003,087 and Kings Park the place home costs have dropped by 6.3 per cent to $976,838, down from $1,042,297.

In Melbourne’s Melton – Bacchus Marsh area, within the metropolis’s north-west, 51.9 per cent of residents have a mortgage, and listings right here have risen by 8.7 per cent in the course of the previous 4 weeks.

On the opposite facet of Melbourne, within the Casey South area protecting Cranbourne East, 56 per cent of households have a mortgage with listings rising 6.1 per cent in 4 weeks.

However in Perth, mortgage belt areas had seen a fall in listings.

Within the Swan area, 54.2 per cent of households have a mortgage however listings have fallen 5.8 per cent on this space east of town protecting Midland.

The Reserve Financial institution’s 12 rate of interest hikes since Might 2022 are essentially the most aggressive since 1989.

Those that borrowed early final 12 months earlier than the hikes started are essentially the most vulnerable to being in mortgage stress, the place they owe the financial institution greater than a 3rd of their earnings in repayments.

Three of Australia’s large 4 banks – Westpac, ANZ and NAB – at the moment are anticipating the Reserve Financial institution to hike rates of interest in July and August to a brand new 12-year excessive of 4.6 per, up from 4.1 per cent now.

The Reserve Financial institution’s June assembly minutes acknowledged most economists expect two extra charge rises.

The Reserve Financial institution’s June assembly minutes acknowledged most economists expect two extra charge rises (pictured is Governor Philip Lowe)

‘Additional forward, round half of economists surveyed anticipated 50 foundation factors of tightening by August, which was broadly consistent with the likelihood implied by market pricing,’ it stated.

The RBA board opted to lift rates of interest in June by one other 25 foundation factors, with April’s inflation charge of 6.8 per cent effectively above its 2 to three per cent goal.

Inflation might stay excessive past mid-2025 if it wasn’t tackled now, the minutes stated.

‘The case for elevating the money charge by an extra 25 foundation factors centered on the elevated threat that inflation would take longer to return to focus on than had been anticipated,’ it stated.

Monetary comparability group Canstar stated anybody who took on a brand new mortgage in April 2022 – when the RBA money charge was at a record-low of 0.1 per cent – seems set to be in mortgage stress inside two months.

That situation relies on a borrower taking out a mortgage the place they owed the financial institution six instances what they earned.

The RBA’s 12 charge rises since Might 2022 have diminished what banks can lend, with these borrowing on the most capability little greater than a 12 months in the past most in danger.

In Melbourne’s Melton–Bacchus Marsh area, within the metropolis’s north-west, 51.9 per cent of residents have a mortgage, and listings right here have risen by 8.7 per cent in the course of the previous 4 weeks

Sydney, Australia’s most costly capital metropolis market, is especially dangerous for somebody who purchased a median-price home for $1,416,960 in April 2022.

A pair on a mixed earnings of $187,542 who borrowed $1,133,568, with a 20 per cent mortgage deposit, face spending 50 per cent of their salaries on mortgage repayments by August.

Canstar utilized this calculation to a few every incomes near the typical, full-time wage of $94,000.

Assuming a rise within the rate of interest on their mortgage climbing from 2.98 per cent in April 2022 to 7.48 per cent by August, their repayments would devour 66 per cent of their post-tax earnings.

Sydney home costs have dropped by 9.2 per cent in the course of the previous 12 months to $1,293,529.

Suburbs north of Blacktown have median costs close to that stage together with Schofields ($1,214,389) and Acacia Gardens ($1,248,340).

In Melbourne, a pair incomes $141,692 between them who purchased a median-price home for $1,000,926 in April 2022 could be owing 47 per cent of their pre-tax earnings servicing $5,553 in month-to-month mortgage repayments for a $800,741 mortgage.

Home costs in Melbourne fell by 8.6 per cent to $911,007 within the 12 months to Might.

The suburbs the place debtors are within the majority embrace Melton the place the median home value is $466,185, Bacchus Marsh the place $638,203 is the mid-point, together with Cranbourne East the place $644,076 is the center value.

In Perth, a pair incomes $95,772 who purchased a $578,751 home could be spending 40 per cent of their earnings managing $3,211 in mortgage repayments on $463,001 of debt.

Home costs within the West Australian capital have elevated by 2.2 per cent to $606,563 regardless of the speed rises however in Midland, within the metropolis’s east, the mid-point value is a extra reasonably priced $407,206.

Unemployment in Might fell to three.6 per cent, down from 3.7 per cent in April, placing it nearer to a 48-year low of three.5 per cent.

Michele Bullock, the RBA’s deputy governor, on Tuesday advised an Australian Business Group operate in Newcastle unemployment must rise to 4.5 per cent by 2024 for wages to cease fuelling inflation.

Economists confer with this because the non-accelerating inflationary charge of unemployment or NAIRU.

‘Whereas 4.5 per cent is increased than the present charge, this end result would nonetheless go away us under the place it was pre-pandemic and never far off some estimates of the place the NAIRU would possibly at present be,’ she stated.

‘In different phrases, the financial system could be nearer to a sustainable steadiness level.’

[ad_2]

Source