2 Millionaire-Maker Synthetic Intelligence (AI) Shares

[ad_1]

The substitute intelligence (AI) market exploded because the begin of final 12 months, creating many millionaires alongside the way in which. The huge potential of the expertise and its capability to spice up numerous industries made buyers bullish about almost each firm that has ventured into AI. In truth, the Nasdaq-100 expertise sector soared 35% since final June, primarily pushed by AI pleasure.

Regardless of the trade’s meteoric rise, AI seems nowhere close to hitting its ceiling and can possible create extra millionaires within the coming years. Knowledge from Grand View Analysis reveals the AI market hit almost $200 billion in spending in 2023 and initiatives that determine to achieve slightly below $2 trillion by the tip of the last decade because the sector expands at a compound annual progress charge of 37%.

Consequently, it could possibly be value investing in a few of AI’s most outstanding gamers and probably revenue from the market’s long-term progress. Listed here are two millionaire-maker synthetic intelligence shares that could possibly be value shopping for this June.

1. Nvidia

Few firms benefited from the boom in AI as a lot as Nvidia (NASDAQ: NVDA). The corporate’s inventory skyrocketed 223% since final June because it has achieved an estimated 90% market share in AI chips.

Years of dominating the graphics processing units (GPUs) market paved the way in which for Nvidia to get a head begin in AI, whereas rivals like Superior Micro Gadgets and Intel scrambled to catch up. GPUs are the popular chips for coaching AI fashions, in order the trade has grown, so has Nvidia’s earnings.

The chipmaker posted its first quarter of 2025 (ending April 2024) earnings on Could 22, reporting income progress of 262% and a 690% enhance in working revenue. The quarter noticed Nvidia get pleasure from one other interval of elevated AI chip gross sales, mirrored in information heart income progress of 427%.

Nvidia’s rise to the highest of the chip market secured it a strong position in AI that is unlikely to dissipate any time quickly. In the meantime, progress catalysts in different tech areas, like video video games, PCs, self-driving vehicles, and extra, may ship good points for years.

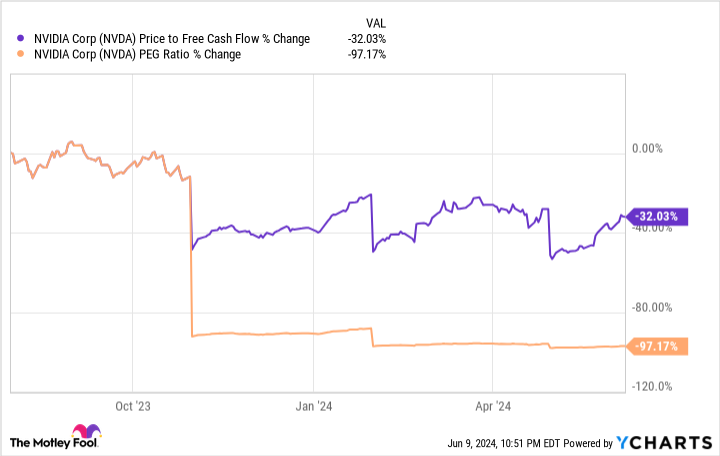

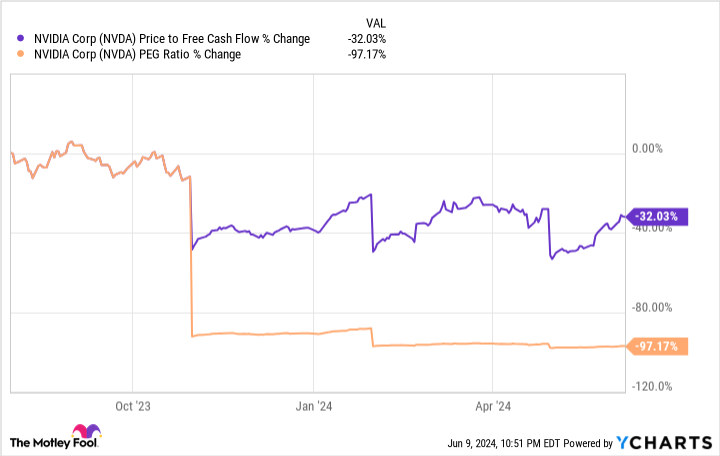

Furthermore, regardless of a hovering inventory value, Nvidia’s inventory truly elevated in worth over the past 12 months. The corporate’s price-to-free money circulation ratio and value/earnings-to-growth ratio decreased by double digits, suggesting Nvidia’s inventory is probably buying and selling at its finest worth in months.

Consequently, Nvidia is a millionaire-making inventory that is simply too good to move up and has huge progress potential within the coming years.

2. Microsoft

Whereas Nvidia dominates the {hardware} facet of AI, Microsoft (NASDAQ: MSFT) achieved a number one position in AI software program. The tech big was an early investor available in the market, sinking $1 billion into ChatGPT developer OpenAI in 2019. That funding has since grown to $13 billion, giving Microsoft unique entry to among the most superior AI fashions within the trade.

Microsoft’s partnership with OpenAI has allowed it to spice up a number of areas of its enterprise with AI. Over the past 12 months, the corporate has launched new generative options to its Workplace productiveness suite, expanded its library of AI instruments on its cloud platform Azure, and even introduced a enterprise into chip design. Microsoft has gone full drive into AI, and its efforts are starting to replicate in its earnings.

Within the third quarter of 2024 (which ended March 2024), Microsoft’s income elevated by 17% 12 months over 12 months, with working revenue leaping 23%. The corporate’s clever cloud section loved a big increase from AI, posting income and working revenue good points of 21% and 32%, respectively.

Microsoft’s Azure has main progress potential in AI as firms more and more flip to cloud companies to combine the expertise into their companies. Azure has the second-largest cloud market share at 25% however is gaining on trade chief Amazon Internet Providers (AWS). In This autumn 2023, Azure’s cloud market share elevated by 2 share factors, whereas AWS’ decreased by 2 factors.

Microsoft’s inventory rose 224% since 2019, little doubt creating quite a lot of millionaires alongside the way in which. In the meantime, the emergence of AI signifies it is not completed but. Shares in Microsoft aren’t the largest worth, with its ahead price-to-earnings ratio at 36. Nonetheless, the corporate’s dominant position in AI and monetary sources make its inventory value its premium price ticket and one to think about earlier than it is too late.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $746,217!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Dani Cook has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Amazon, Microsoft, and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel, lengthy January 2026 $395 calls on Microsoft, brief August 2024 $35 calls on Intel, and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

2 Millionaire-Maker Artificial Intelligence (AI) Stocks was initially printed by The Motley Idiot

[ad_2]

Source