How the world’s smelliest fruit is making espresso dearer

[ad_1]

How a lot is an excessive amount of for a caffeine repair?

Costs like £5 in London or $7 in New York for a cup of espresso could also be unthinkable for some – however might quickly be a actuality because of a “good storm” of financial and environmental elements on the earth’s prime coffee-producing areas.

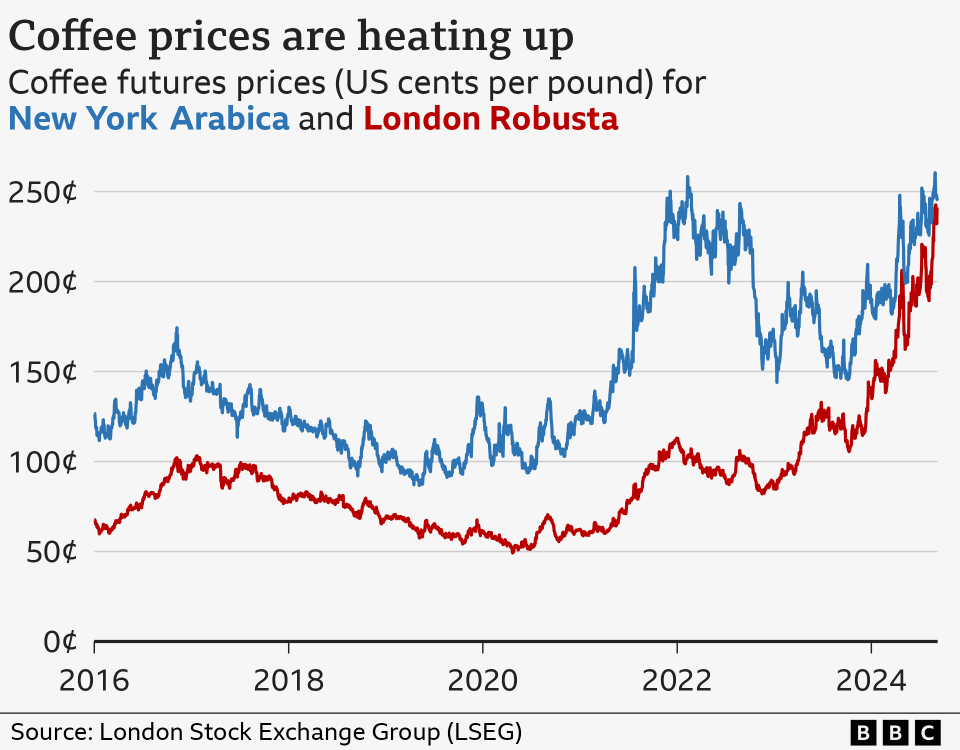

The price of unroasted beans traded in international markets is now at a “traditionally excessive degree”, says analyst Judy Ganes.

Consultants blame a mixture of troubled crops, market forces, depleted stockpiles – and the world’s smelliest fruit.

So how did we get right here, and simply how a lot will it affect your morning latte?

In 2021, a freak frost worn out espresso crops in Brazil, the world’s largest producer of Arabica beans – these generally utilized in barista-made espresso.

This bean shortfall meant consumers turned to international locations like Vietnam, the first producer of Robusta beans, which might be usually utilized in immediate blends.

However farmers there confronted the area’s worst drought in practically a decade.

Local weather change has been affecting the event of espresso vegetation, in response to Will Firth, a espresso guide primarily based in Ho Chi Minh Metropolis, in flip impacting bean yields.

After which Vietnamese farmers pivoted to a smelly, yellow fruit – the durian.

The fruit – which is banned on public transport in Thailand, Japan, Singapore and Hong Kong due to its odour – is proving well-liked in China.

And Vietnamese farmers are changing their espresso crops with durian to money in on this rising market.

Vietnam’s durian market share in China virtually doubled between 2023 and 2024, and a few estimate the crop is 5 instances extra profitable than espresso.

“There’s a historical past of growers in Vietnam being fickle in response to market worth fluctuations, overcommitting, after which flooding the market with portions of their new crop,” Mr Firth says.

As they flooded China with durian, Robusta espresso exports have been down 50% in June in comparison with the earlier June, and shares have been now “close to depleted”, according to the International Coffee Organisation.

Exporters in Colombia, Ethiopia, Peru and Uganda have stepped up, however haven’t produced sufficient to ease a good market.

“Proper at [the] time when issues began to rev up for demand of Robusta, is correct when the world was scrambling for extra provide,” explains Ms Ganes.

This implies Robusta and Arabica beans at the moment are buying and selling at near-record highs on commodity markets.

A brewing market storm

Is the shifting international espresso economic system truly impacting the value of your espresso on a excessive road? The quick reply: doubtlessly.

Wholesaler Paul Armstrong believes espresso drinkers might quickly face the “loopy” prospect of paying greater than £5 within the UK for his or her caffeine repair.

“It’s an ideal storm on the minute.”

Mr Armstrong, who runs Carrara Espresso Roasters primarily based within the East Midlands, imports beans from South America and Asia, that are then roasted and despatched to cafés across the UK.

He tells the BBC he not too long ago elevated his costs, hoping it will account for the upper asking costs – however says prices have “solely intensified” since.

He provides that with a few of his contracts ending within the coming months, cafés he serves will quickly need to resolve whether or not to move the upper prices on to their clients.

Mr Firth says some segments of the business will probably be extra uncovered than others, although.

“It’s actually the industrial amount espresso that may expertise essentially the most disuption. Instantaneous espresso, grocery store espresso, stuff on the fuel station – that is all going up.”

Business figures warning {that a} excessive market worth for espresso might not essentially translate into larger retail costs.

Felipe Barretto Croce, CEO of FAFCoffees in Brazil, agrees that buyers are “feeling the pinch” as shopper costs have risen.

However he argues that’s “principally resulting from inflationary prices basically”, corresponding to lease and labour, moderately than the price of beans. Consultancy Allegra Methods estimates beans contribute lower than 10% of the value of a cup of espresso.

“Espresso remains to be very low-cost, as a luxurious good, when you make it at dwelling.”

He additionally says that the price of lower-quality beans rising means high-quality espresso might now be seen as higher worth.

“Should you go right into a speciality espresso store in London and get a espresso, versus a espresso in Costa Espresso, the distinction [in price] between that cup and the speciality espresso is way smaller than it was once.”

However there may be hope of worth reduction on the horizon.

Shedding future floor

The upcoming spring crop in Brazil, which produces a 3rd of the world’s espresso, is now “essential”, in response to Mr Croce.

“What everyone seems to be taking a look at is when the rains will return,” he says.

“In the event that they return early, the vegetation ought to be wholesome sufficient and the flowering ought to be good.”

But when the rains come as late as October, he provides, yield predictions for subsequent yr’s crop will fall and market stress will proceed.

In the long run, local weather change poses severe challenges for the worldwide espresso business.

A study from 2022 concluded that even when we drastically scale back greenhouse fuel emissions, the world most extremely suited to rising espresso might decline by 50% by 2050.

One measure to future-proof the business that has the assist of Mr Croce is a “inexperienced premium” – a small tax levied on espresso given to farmers to put money into regenerative agricultural practices, which assist shield and maintain the viability of farmlands.

So whereas smelly fruit is partly accountable for worth rises now – a altering local weather might in the end pressure the affordability of espresso within the years to come back.

[ad_2]

Source