Dave Ramsey revealed the actual motive People are going broke — and it is not inflation. 3 easy steps to repair your funds now

[ad_1]

File-breaking inflation charges might have throttled People’ budgets during the last yr, however Dave Ramsey says you’ll be able to’t blame excessive prices for all of your monetary woes.

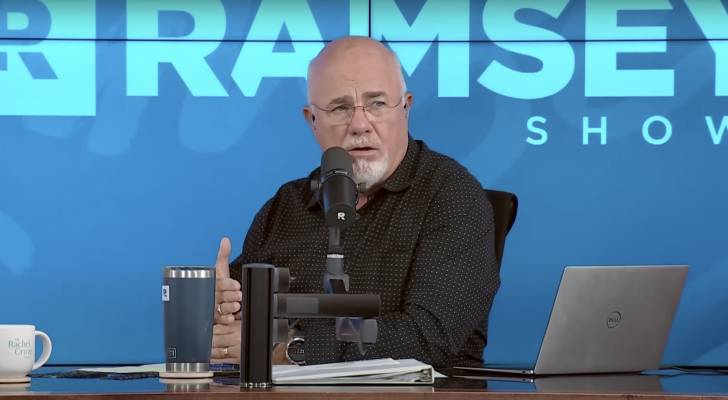

On a well-liked episode of The Ramsey Present, host Ramsey acknowledged that family debt is at an all-time excessive — not as a result of inflation is rising the value of important items like groceries, however due to how shoppers have responded to those worth adjustments.

Don’t miss

“Let’s be clear right here. The debt will not be due to inflation,” Ramsey said during the episode. “The debt is since you wussed out and refused to chop your freaking way of life to offset inflation.”

What Ramsey says is holding folks again

You’ll be able to save enough for retirement by placing $100 monthly in a conservative development fund from age 25 to 65, Ramsey stated, however for that to work, “You’ll be able to’t have a $750 F-150 fee. You’ll be able to’t have a scholar mortgage that’s been round so lengthy you suppose it’s a pet.”

He added: “All you do is figure for these stinking banks which have higher furnishings and larger buildings than you do.”

Ramsey went on to state that debt has develop into normalized in America if not all through the world. It’s now a huge obstacle for these looking for to save cash and put that money towards retirement.

But, as a substitute of paying again debt, shoppers appear to be utilizing bank cards and different mortgage strategies to proceed funding their every day spending, Ramsey stated. Reasonably than reduce throughout inflation, shoppers selected to make up for the shortfall by borrowing money to maintain their lifestyles.

Ramsey acknowledged that individuals’s continuous reliance on client debt has stored him within the monetary advice-giving enterprise for the final a number of many years and can give him job safety for a number of extra.

That’s why it’s a good time to remind People about Ramsey’s baby steps to safe your funds and kick debt to the curb.

Create a $1,000 emergency fund

Ramsey’s steering right here is to start out an emergency enjoyable with $1,000. He is since come out to say that was never meant to be enough for People. Nonetheless, whilst you’re employed to pay down your debt, that is the naked minimal quantity it’s best to have put apart, as a result of life occurs.

Down the road, you can begin contributing way more to this fund. However, if you happen to’re instantly hit with a giant medical invoice, a broken-down automobile or another emergency, you’ll need that $1,000 obtainable to keep away from dropping all of the steam you’ve gained in your debt funds.

Learn extra: Because of Jeff Bezos, now you can use $100 to cash in on prime real estate — with out the headache of being a landlord. Here is how

Repay all debt (besides the home)

Granted, virtually nobody has a whole lot of 1000’s of {dollars} obtainable to repay their mortgage in a single go, however by utilizing the snowball method People pays down the remainder of their debt in a fairly fast time frame, Ramsey claims.

To do that, record your money owed, from student loans and automotive funds to bank cards. Organize them from the smallest stability to the biggest, no matter rate of interest, Ramsey says. Begin making the minimal funds on all the pieces besides that little mortgage, placing all the pieces you’ll be able to towards it. The smallest mortgage is commonly a bank card stability, which is useful, because it’s often additionally the account with the best rate of interest. Repeat with the following smallest stability, then the following, till you’re debt-free.

Attaining that is going to require you to cut back spending, Ramsey says — so it could be time to re-evaluate what’s truly mandatory in your life.

“While you truly take into account the way in which all of us stay, it’s outrageous,” Ramsey stated. “Our existence are outrageous.”

Create a totally funded emergency fund

Now, cease for a minute and rejoice. You’ve paid off your debt! This can be a large step that deserves congratulations. However there’s nonetheless a lot extra to do. You’ll be able to start investing and saving toward long-term goals. Earlier than any of that, nonetheless, you will wish to circle again and high up your emergency fund.

Ideally, it’s best to have between three and 6 months of bills put apart on your family. This implies you’re going to have to return and have a look at what you’ve spent during the last three to 6 months. On the brilliant facet, by now you might have already reduce on bills dramatically. Even higher, you’ve created a behavior of paying down debt on a constant foundation. So, now you merely put the cash you had been utilizing on debt towards financial savings.

As soon as this emergency stash is funded, you’ll be protected ought to considered one of life’s huge surprises — like a layoff or lengthy hospital keep — comes your means. In the event you’re fortunate, this received’t occur and you need to use your emergency fund as earnings down the street. However having it obtainable offers you peace of thoughts.

“You simply should look within the mirror and inform your self, ‘Boy, we purchase some actually silly stuff,’” Ramsey stated. “Don’t be a sufferer. You’re not a sufferer. You’re a sufferer of the individual in your mirror.”

What to learn subsequent

This text supplies data solely and shouldn’t be construed as recommendation. It’s offered with out guarantee of any variety.

[ad_2]

Source